Politicians seem to love a good crisis, whether real or imagined. We do have a retirement savings crisis, but there’s a lot of misinformation being circulated as fact. The crisis is that American’s aren’t saving enough, in general, to have a comfortable retirement. The misinformation is in how dismal the picture is.

What seems to be most quoted is a Government Accountability Office (GAO) statistic that 48 percent of U.S. households aged 55 or older have no retirement savings. That seems to be a pretty clear problem.

What the number doesn’t include, though, are the households who have defined benefit plans, but no retirement savings. And there are lots of them. Many are government employees covered by pretty lucrative plans. If you add those into the mix, the number drops to 29 percent of U.S. households age 55 or older have no retirement savings in the form of a retirement account or a pension. Still ugly, but not as attention-grabbing.

Still, what if you’re one of those? What should you do to save for retirement if you’re starting late?

The Best Time to Start Saving for Retirement

From a technical perspective, the best time to start saving for retirement is when you first enter the workforce. This gives your savings the greatest amount of time to grow and should produce the greatest future value at the time of retirement.

From a practical perspective, let’s say that didn’t happen.

Then the next best time to start saving is today. Even if you’re 40. Even if you’re 50. Even if you’re 65 and retiring soon.

It’s always better to start saving late than never. And there’s a reason for that.

The Retirement-Timing Misconception

A lot of advice is focused on how much we need to accumulate to retire comfortably and how much income you need to have to maintain your standard of living in retirement. And if it’s decent advice, it mentions something about scaling up across time for inflation. And we nod. Yes, why certainly we do need that!

But do we really understand that? If we’re putting a bit of a dent into our retirement savings day one, we’ll run into trouble. We really need the bulk of our savings for later in retirement. And here’s why.

Income vs. Expenses in Retirement

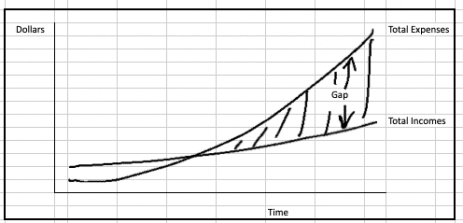

Imagine you have some base of income in retirement, usually at least Social Security, maybe Social Security and a pension. Across time, this income will trend up slowly, with Social Security increasing at about half the rate your expenses really go up by, and your pension may be increasing a little, but often not at all.

Then picture an expense line. This line will increase at a growing rate. Expenses get larger by an increasing amount each year. The income line won’t keep up with the expense line. The expenses grow rapidly while the income grows slowly. The gap between the increasing expenses and the fairly stable income is what you need to fund from your retirement savings. You need a lot more in later retirement than you do in early retirement. It looks like this:

This can get you into trouble if you’re not careful. The effect of inflation across time is huge.

The antidote is savings. And even if retirement is close, you can save for this future gap. You’ll need additional money 20 and 30 years into retirement. It still has time to work for you. This is also why you shouldn’t be super conservative with all of your investments when you retire. They still need to be working for you. Most of them do, even if you need a little for now.

Saving and/or Working Into Retirement

Starting late and not stopping is one way to address the “saving late for retirement” problem. Paring back unnecessary expenses may enable you to lower your expenses below your initial retirement income. If you have little to nothing saved, this will be an important strategy.

You can also boost your income by continuing to work at least part-time. Working can have the added benefit of allowing you to postpone taking out Social Security. When retirement is gonna be tight and every little bit helps, the increase you get from starting benefits later can be a real difference-maker.

Consider Your Big Expenses Carefully

For many retirees, a few big expenses consume most of the budget. These are typically housing, healthcare, and transportation.

If you’re getting a late start on retirement savings, it may be necessary to make some changes in these big expenses.

If you live in a state with high property taxes, it can make sense to relocate to more tax-friendly place. It’s not uncommon for people around me to leave our state to save $10,000 to $12,000 a year in property taxes. In some cases, the savings are far larger. That can make a difference between a miserable existence and a comfortable retirement.

To put it in perspective, if you’re planning your retirement withdrawals at 3 percent of assets annually, you’d need an additional $400,000 of retirement assets to fund an additional $12,000 per year of property taxes. Cutting your property taxes by $12,000 per year is equivalent to adding $400,000 to your retirement savings. It has the same basic effect.

One car instead of two; a smaller, more efficient car; and proper health-care planning can reduce your budget or reduce the unpredictability of large expenses.

One caution, though: Avoid knee-jerk decisions. If you can save $12,000 per year on taxes, but will spend $14,000 per year traveling back to see the grandkids, you’re not getting ahead financially. In that case, you might consider downsizing or moving locally to reduce and save a portion of the taxes without incurring increased travel expenses.

Know Your Budget

Any time you seek to do better financially, budgets come into play. This makes sense. If you want to do better, you need to know what you’re doing better than. You need to know what’s coming in and what’s going out if you’re going to make decisions to improve the situation.

You can only accurately forecast future expenses if you base your projections off of valid current ones.

Whether you’re looking for places to trim expenses or see if an additional expense is affordable, you’ll need a clear picture of where you are currently. Just like any other time, when planning for retirement, a budget is the foundation on which your plans are built.

Saving Late for Retirement: Time to Pull It All Together

If you haven’t saved, you still can. Even if retirement is close. Even if it’s already started. Your biggest need isn’t upon retirement — it’s well into retirement. Inflation will make things cost more. Across time, it will make things cost a lot more.

When we look at the statistics, we ultimately realize that’s not what’s most important. That’s a barometer for the country. We, however, need to also be concerned with where we’re at individually.

If you haven’t started yet, now’s the time. Don’t focus on how short you are. Focus on doing as much as you can. Be careful with expenses. Plan the big things especially carefully. Reducing big expenses can go a long way toward making retirement affordable. Don’t give up. You may not be able to do everything you want when you start saving for retirement late, but you can always do better.

Pingback : Addressing the Fear of Running Out of Money in Retirement